- #AUSTRALIAN PERSONAL FINANCE SOFTWARE PROFESSIONAL#

- #AUSTRALIAN PERSONAL FINANCE SOFTWARE SERIES#

- #AUSTRALIAN PERSONAL FINANCE SOFTWARE DOWNLOAD#

#AUSTRALIAN PERSONAL FINANCE SOFTWARE DOWNLOAD#

Download the Free TemplateĮnter your name and email in the form below and download the free template now!

#AUSTRALIAN PERSONAL FINANCE SOFTWARE PROFESSIONAL#

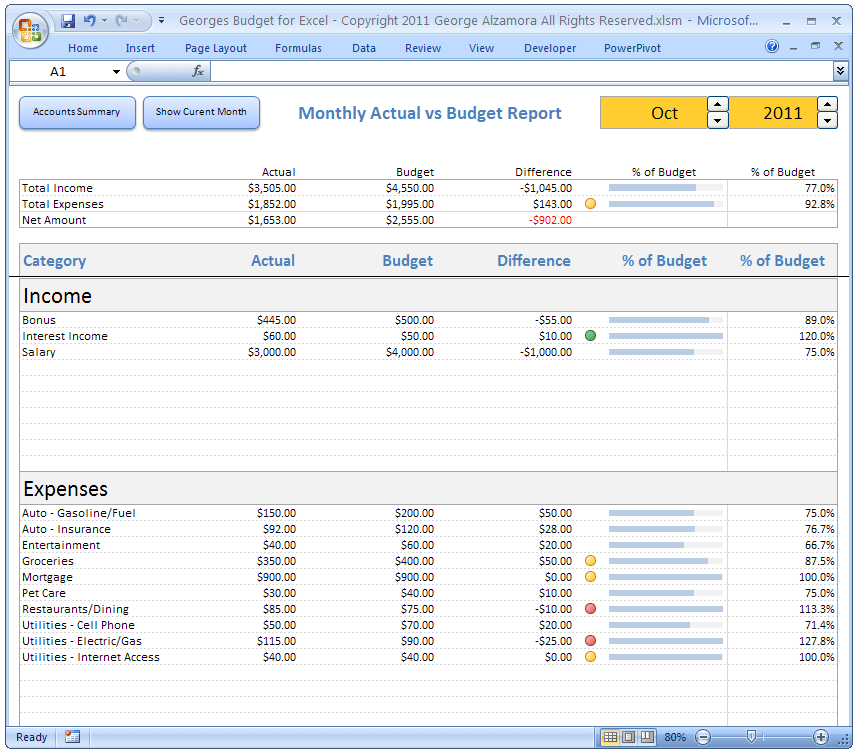

Additionally, you should always consult a professional advisor before making any financial or investment decisions. If you’d like to use this free template to help you with your personal finances and planning, please download the Excel spreadsheet and edit it as appropriate to fit your own needs. Below is an example of a simple monthly budget that could be used to manage your income, expenses, savings, and investments.Īs you can see in the example below, there are three potential sources of income (salary, bonus, and other), followed by a list of expenses (rent, food, groceries, restaurants, entertainment, childcare costs, vacations, etc.), and the difference between the two is the person’s monthly surplus or deficit. Preparing a budget or a financial plan is critical for giving you the best shot at achieving your personal and family goals. Generally speaking, the main components of the financial planning process are: These plans are commonly prepared by personal bankers and investment advisors who work with their clients to understand their needs and goals and develop an appropriate course of action. All of the above areas of personal finance can be wrapped into a budget or a formal financial plan. Good financial management comes down to having a solid plan and sticking to it.

#AUSTRALIAN PERSONAL FINANCE SOFTWARE SERIES#

There is a whole series of analysis that needs to be done to properly assess an individual’s insurance and estate planning needs. This is another area of personal finance where people typically seek professional advice and which can become quite complicated. Personal protection refers to a wide range of products that can be used to guard against an unforeseen and adverse event. There are vast differences in risk and reward between different investments, and most people seek help with this area of their financial plan. Investing is the most complicated area of personal finance and is one of the areas where people get the most professional advice. This is where we see the relationship between risk and return. Investing carries risk, and not all assets actually end up producing a positive rate of return. Investing relates to the purchase of assets that are expected to generate a rate of return, with the hope that over time the individual will receive back more money than they originally invested. Having too much savings, however, can actually be viewed as a bad thing since it earns little to no return compared to investments. Most people keep at least some savings to manage their cash flow and the short-term difference between their income and expenses. Managing savings is a critical area of personal finance. If there is a surplus between what a person earns as income and what they spend, the difference can be directed towards savings or investments. Saving refers to excess cash that is retained for future investing or spending. Good spending habits are critical for good personal finance management. Managing expenses is just as important as generating income, and typically people have more control over their discretionary expenses than their income. If expenses are greater than income, the individual has a deficit. The expenses listed above all reduce the amount of cash an individual has available for saving and investing. The majority of most people’s income is allocated to spending. All spending falls into two categories: cash (paid for with cash on hand) and credit (paid for by borrowing money).

Spending includes all types of expenses an individual incurs related to buying goods and services or anything that is consumable (i.e., not an investment). In this sense, income can be thought of as the first step in our personal finance roadmap. These sources of income all generate cash that an individual can use to either spend, save, or invest. It is the starting point for our financial planning process.

Income refers to a source of cash inflow that an individual receives and then uses to support themselves and their family. Each of these areas will be examined in more detail below. In this guide, we are going to focus on breaking down the most important areas of personal finance and explore each of them in more detail so you have a comprehensive understanding of the topic.Īs shown below, the main areas of personal finance are income, spending, saving, investing, and protection.

This guide will analyze the most common and important aspects of individual financial management. The process of managing one’s personal finances can be summarized in a budget or financial plan. Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

0 kommentar(er)

0 kommentar(er)